You are currently browsing the tag archive for the ‘Stock’ tag.

If you buy a PUT option on that stock, you have the right to sell that stock at a certain price by a certain date. You do not have an obligation to sell the stock, it is your choice. There are a few variables that go into the price of the put option the same as a CALL option. The main variables are the Strike Price, the Expiration Date and the Price of the Stock.

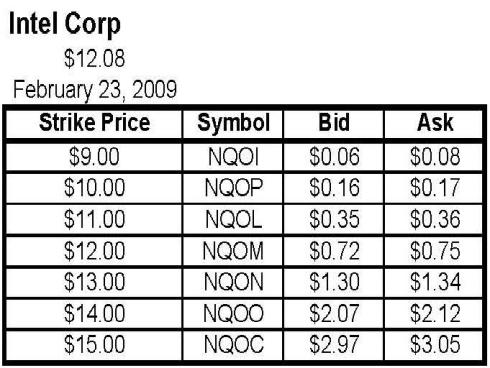

Lets look at Intel Corporation (INTC) as an example. On February 23, 2009 INTC closed at $12.07Bid/$12.10Ask. The following is a list of near the money Call options that expire in March 2009.

Put Options - Intel February 23, 2009

If you purchased one March $12 Put (symbol NQOM) for $0.75 (plus transaction costs) today, you would have until the March 20th (the third friday of March) Expiration date to EXERCISE the option. If you exercise the option, you would give your broker 100 shares of Intel (INTC) and your broker would pay you $12/share (plus transaction costs).

Why would you do this?

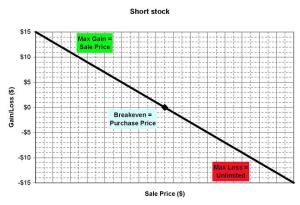

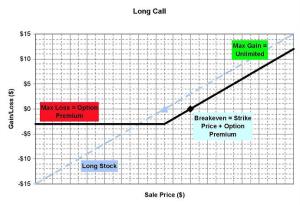

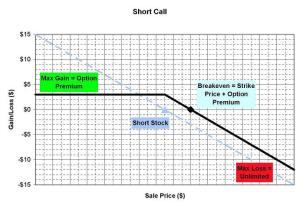

Perhaps you think INTC is going to announce something that will make the stock FALL between now and when the option expires. If you think the stock is going to fall, then you can do a few things. The first would be to SHORT the stock (see earlier posts) or you could purchase a PUT. (There are other things as well that I will discuss later)

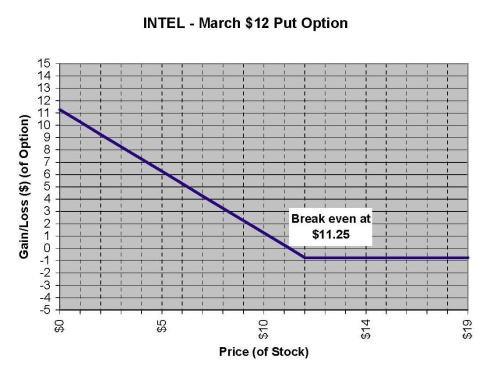

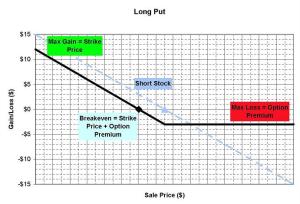

If INTC makes an announcement and the stock falls to $10.00/share, you will have a gain of $2.00/share less what you paid for the option ($0.75), for a total gain of $1.25/share (less transaction costs). If INTC stays above $12.00 you will not exercise the option and it will expire worthless, for a maximum loss of $0.75. If INTC falls to $11.25, you will break even (not including transaction costs). If you had shorted the stock, and it rises to $13.00, you would have lost $1.00, and it could go higher.

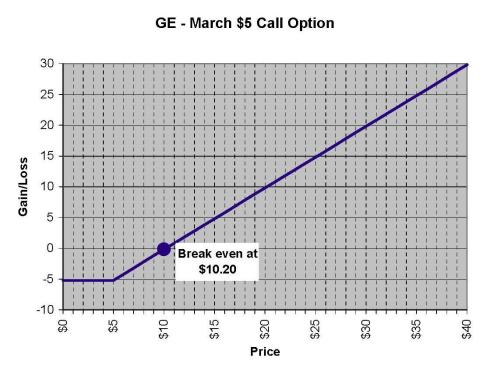

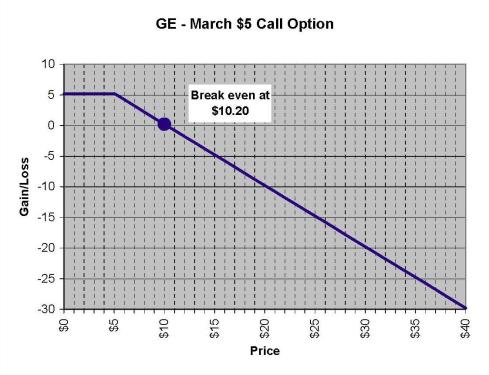

Lets look at the risk/reward graph, at the expiration date.

$12 March 2009 INTEL Put

If INTC stock is below $11.25 (less transaction costs) the options will produce a gain. If INTC stock is above $12, the options will expire worthless, and the maximum loss of $0.75 will be realized. In between $11.25 and $12.00 the options will incur some gain.

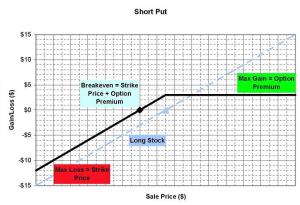

If we compare the graph for being SHORT (selling) a stock vs. buying a Put, one can see that we have limited the downside, while maintaining an unlimited upside potential (Not necessarily unlimited as the price of a stock can only go down to $0), by buying a Put.

CONS: The put option has a time limit. If we purchased the $12 put (symbol NQOM) for $0.75 and the stock were to stay above to $12.00 the put will expire worthless and we will lose $0.75 at expiration.

Do not be disappointed yet, remember, I am trying to explain the basics before I explain more complex combinations.

To be continued—

Comments