You are currently browsing the tag archive for the ‘Stock’ tag.

When I own an asset, it is also known as being LONG an asset. If I buy a stock, I am long the stock. Assets can take many forms, a few examples are stocks, bonds, real estate, commodities, automobiles, etc.

When you purchase an asset, there are three possibilities that can happen in the future.

1. The asset can appreciate, meaning you will be able to sell it for more than you purchased it. This will result in a gain, and depending on the type of account it is held in, you may owe taxes on the gain. These are the assets that we want to own.

2. The asset can retain its value, it neither appreciates nor depreciates. You will be able to sell this asset in the future for the same amount that you paid for it.

3. The asset can depreciate, meaning that when you sell it in the future, you will sell it for less than what you paid for it. This will result in a loss, and depending on the type of account it is is held in, you may have a loss to claim on taxes. Who would purchase an asset that depreciates? Every adult that I know owns at least one depreciating asset……their car.

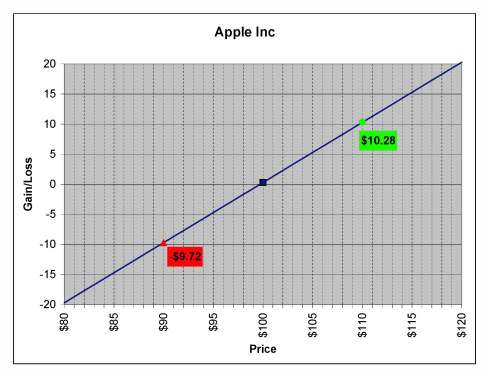

This is a risk/return graph for the owning an asset, I will use Apple on February 6, 2009 for this example.

Apple as of Februart 6, 2009

As you can see, at any price lower than the purchase price of $99.72 (the closing price on February 6, 2009), you will incur a loss. At any price above $99.72, you will have a gain, and at $99.72 this will be an even trade.

I have simplified this example, please remember that some stocks will have a dividend, stock splits, etc. that will affect this calculation. For example, if you were to receive a dividend, it could be argued that this reduces your cost. Please also remember that time value can be a factor in the calculation.

This is a general definition. A stock or share represents a portion of ownership of a company. Also known as equity. If company XYZ has 1,000 shares of stock outstanding and each share has a price of $30, then Company XYZ is worth $30,000 (=$30 x 1000). This $30,000 is also called the Market Capitalization of Company XYZ. If you wanted to buy all (100%) of Company XYZ you would need to pay $30,000. If you own 100 shares, you would own 10% (=100/1000) of the company. When you own 1 share of stock, you are entitled to the proportional amount of assets in the company after liabilities are paid. You are also entitled to a share of the future profits, these can take the form of Dividends. And last, but not least, you are normally entitled to a vote at the annual share holders meeting. These entitlements are normal and the majority of stocks traded at the New York Stock Exchange (NYSE) or National Association of Securities Dealers (NASDAQ) will have them, however, you should verify them with any specific stock that you are interested in investing.

The price of each share can be found in many locations in print (the Wall Street Journal, the Financial Times, Investors Business Daily or your local newspaper are a few) or online (at sites like Yahoo.com, CNBC.com, or any online broker to name a few). You can also get a quote from your broker. Unless you are an active trader or have a large account most of the prices that you can find online are delayed quotes. These quotes are delayed by about 20 minutes. I will compare brokers in a later post.

If you get a quote online, it will be given with two or three prices. Do not let this confuse you. One price will be the Bid price, one price will be the Ask price, and the third price may be the last price. The Bid price is the price that someone will buy the stock from you if you want to sell the stock. The Ask price is the price that someone will sell the stock to you. The difference between the Bid and the Ask is called the spread. Normally, you can buy or sell the stock at a price in between the Bid and the Ask price.

Comments